US exports of petroleum and petroleum derivatives, natural gas and coal have doubled in the last three years, reaching 110.2 billion dollars. For almost four decades US had no real federal energy strategy, relying mainly on the policies and measures taken in each state. But then the country became a net exporter of energy in 2011 for the first time after 20 years amid increasing domestic production of oil, gas and coal, and falling prices for these raw and refined materials.

Financial Times estimated that the oil and coal exports rose to 110.2 billion dollars in the period between 1 July 2012-30 June 2013, compared with 51.5 billion in the fiscal year that ended in June 2010. Official data available indicates that major world economies and

With this trend, and the fact that in Europe coal faces again a golden age, the US is still the second largest coal producer worldwide. Financial Times notes that oil and gas exports increased by 68.3% over this period, making the energy sector the sector with the highest growth in American economy when it comes to exports growth. The exports rose overall by 32.7% over the past three years. If in January 2010 US exports amounted to 143 billion dollars per month, in June 2013 they amounted to 191 billion dollars per month, of which 134 billion dollars were obtained from the export of goods.

Reviving exports of raw materials and refined products represents a shift in US policy and economy from manufacturing to services. This explains the launch by Barack Obama in early 2010 of a target of doubling U.S. exports over the next five years from that date, an objective aimed at manufacturing revival, seeking to stop the relocation of industries and American jobs on other meridians.

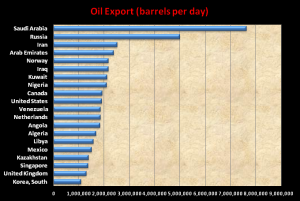

The increase of American oil production and exports makes China the main importer of crude oil

Financial Times announced this year another great twist on the structure of the global economic system. Amid continued growth in production and exports, the necessary quantities that the U.S. must import to satisfy its fuel demand decreases. US oil production has

According to the customs authorities in Beijing, the net imports of crude oil and petroleum based products of China rose to 6.12 million barrels per day in December of 2012, and 2013 began with an increase in imports of up to 6.3 million barrels per day. However, the U.S. remains the largest net importer. The CIA World Fact Book shows that in 2012 US were the largest single oil importing country in the world with more than 10 million barrels per day, followed by China with an average of 5.72 million barrels per day. But while Chinese imports certainly grow from year to year, US imports are already at the minimum of the last two decades.