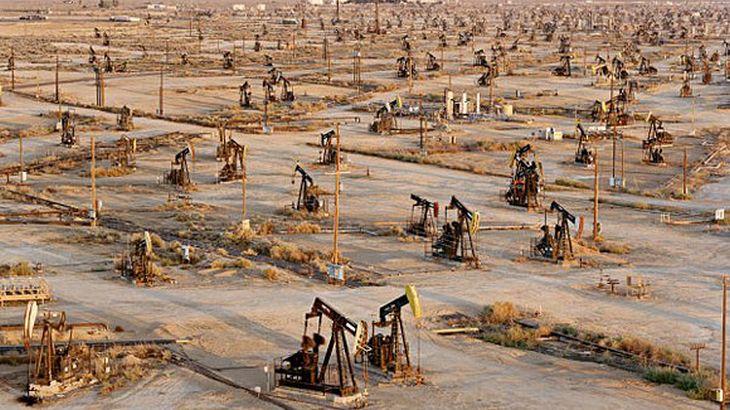

Total, Royal Dutch Shell and Lukoil are among the major oil companies who have selected the oil and gas fields they want to develop in Iran – a country whose oil reserves are ranked fourth in the world – after authorities in Tehran have submitted to investors 70 projects worth 30 billion dollars, according to Bloomberg.

Total and ENI want to invest in Iran, said Iranian Oil Minister, Bijan Namdar Zanganeh. Anglo-Dutch Shell and Russian company Lukoil have specified which fields will develop in Iran, added Ali Kardor, deputy director of investment and financing of the National Iranian Oil Co.

After more than a decade of negotiations, Iran and countries from the “5 + 1” group (the US, Russia, China, Great Britain, France and Germany) reached on 14th of July a comprehensive agreement that put an end to Western concerns on Tehran’s controversial nuclear program. Following the conclusion of this agreement, a number of sanctions on Iran’s economy will be lifted.

Removing sanctions allow Iran to resume oil exports gradually. “All economic and banking sanctions will be lifted until the first week of January”, assured the Iranian oil deputy minister, Amir Hossein Zamaninia.

Stephane Michel, head of exploration and production in the Middle East for Total, said: “We are interested to return to Iran when sanctions will be lifted and if the contracts will be interesting. We worked a long time in this country, we know the fields we worked at.”

Iran will have no problem to sell additional 500,000 barrels per day after the lifting of sanctions and the amount will not have a significant impact on prices, said Zamaninia. He added that the authorities in Tehran hopes to reach an agreement with the Organization of Petroleum Exporting Countries (OPEC) so that the planned increase in production by Iran to stay within the ceiling set by OPEC, 30 million barrels per day.

The Iranian oil deputy minister said that his country does not expect OPEC to change ceiling at the next meeting scheduled to take place on December 4th. Iran plans to increase its total production capacity to 5.7 million bpd by the end of 2020, and according to Bloomberg data in October the state has pumped 2.7 million barrels per day.

Iran may sign the first development contract in March or April, estimated Ali Kardor, deputy director of investment and financing of the National Iranian Oil Co. “The next step (after presenting the legal framework to investors – e.n.) will be conducting technical assessments by foreign energy companies and choosing an Iranian partner,” said Kardor.

Agerpres