From celebration, to funeral. This course is felt throughout the renewable energy sector by between 2008 and 2016. From enthusiasm generated by Romania’s commitments to support the development of green resource generation, most of the companies in this field have come now ever closer to insolvency. Companies and business associations’ dialogue find that talking with authorities leads nowhere, and the only option seems to be calling Romania before an international arbitral tribunal to obtain some financial repairs.

Drastic changes of the support scheme began at the end of 2014 and were followed by regulatory changes, all resulting in substantial reduction of income for producers of wind and solar energy resources. Currently, the market for green certificates is jammed with volumes of trading close to zero, and drowned in an excess of allowances impossible to sell.

Romania committed to a mandatory quota system for green certificates

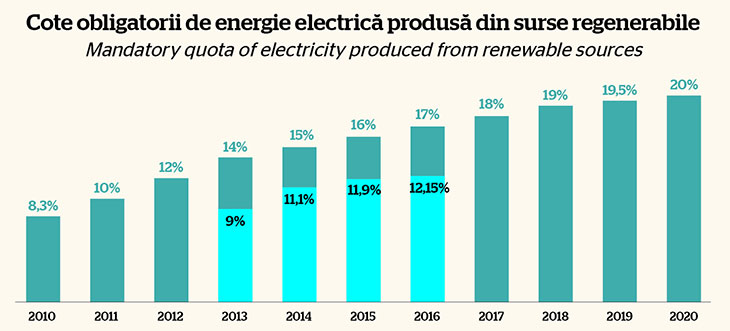

Investments in renewable relied equally on mandatory quota system for electricity produced from renewable energy sources, which provided annual increases, according to a firm timetable for the interval 2010 (8.3%) – 2020 (20%). To reduce pressure on consumer bill, ANRE established green energy rates lower in recent years compared to the initial commitments.

As a result, in the market has remained and has accumulated a growing surplus of green certificates for which there are no buyers. For energy producers, this phenomenon means estimated revenues at that time of investment, but not realized which causes problems in returning loans to banks, but also in providing resources for current activities. Most affected are small producers and those who do not have other activities.

In addition, at the pressure of large electricity consumers, the Government has decided to partially exempt almost 40 companies from payment of green certificates in 2015. While the Ministry of Economy pushed for retroactive application, ANRE endorsed the view that application of the exemption provided by agreements will be done after the issue date and not from 1 January 2015, as hinted by the primary rule.

Romania considers unrealistic rates of return

Positions coming from the renewable sector associations raise the desperate situation of most producers, who face rates of return close to zero or even negative. However, the authorities refer to reported profits of some companies, mainly in the photovoltaic sector. “These are paper gains that are not found in financial flows”, explains Moses Martin, senior vice president at PATRES. The main element of distortion stems from the fact that the certificates issued are taxed when issued and not at the time of sale. “Basically, producers are given a fictitious income, which does not materialize, but is taxed”, explains Moses.

About 700 companies have invested in recent years over 7 billion euro in generating units. As a result, the plants to produce electricity from renewable sources reached a total installed capacity of 5.142 MW at the end of 2015, according to data centralized by Transelectrica. Thus, in the system existed wind farms with a rated output of 3,129 MW, solar parks with a total capacity of 1,325 MW, 585 MW in small hydro and biomass projects with an aggregated power of 103 MW.