EBRD makes a review of the major renewable energy projects in which it has invested. Whiule projects of tens and hundreds of millions of dollars worth are unattainable without the credibility support by an institution such as the European Bank for Reconstruction and Development, the choices EBRD has made give us an indication of the type of major projects that might have a chance of execution in future years. Also, the list below may be useful to Romanian companies capable to respond with products and services as subcontractors in those countries.

“Pioneering renewable energy” is the title of an article by Svitlana Pyrkalo published on www.ebrd.com website at the end of April.

What is good for the environment is also good for the economy

The EBRD is the largest investor in renewable sources of energy in the regions where it operates. Since 2006 the EBRD had invested €4.6 billion in renewable energy generation. In many countries the Bank has pioneered the use of renewable energy resources. In each region where the EBRD works, it is leading the way.

This is good for the economy and good for the environment. “[It] is certain that increased use of renewable energy will play a central role in helping countries meet their climate commitments [under the Paris COP21 agreement]. Just as crucial will be the role of the private sector in financing the next stage of the renewables revolution,” says Riccardo Puliti, EBRD Managing Director for Energy and Natural Resources.

In 2014, the Bank’s investments in renewables overtook those for thermal power generation. The EBRD finances larger renewables directly and smaller projects through special credit facilities via local partner banks.

Renewables without borders

Renewable energy strengthens energy security by providing local energy sources for domestic consumption. But it can also flow across borders, helping out neighbours in need. The EBRD has financed one cross-border transmission line, the Black Sea Transmission Line (BSTL), and is working on another, CASA-1000. BSTL brings hydro-generated electricity from Georgia to Turkey, which has a large and growing energy market.

The high-voltage line spurred a wave of private investment, including foreign funding, in Georgia’s hydropower sector. The largest of these is the Shuakhevi hydropower plant (HPP). Meanwhile, a host of smaller private investors were able to build mini hydropower plants.

CASA-1000 is an ambitious multilateral project which aims to deliver surplus hydropower from Tajikistan and the Kyrgyz Republic into Afghanistan and Pakistan during the summer season.

Southern and eastern Mediterranean

The sun-drenched countries of the southern and eastern Mediterranean region hold enormous potential for solar energy. But a sunny climate on its own will not draw in financing; investors also need an enabling business climate.

The EBRD is bringing in its own finance and also working to improve business conditions in order to attract additional funding. In late 2015 the Bank approved a US$ 250 million financing programme for the generation of renewable energy in Egypt, Jordan, Morocco and Tunisia. This framework is only the beginning and will act as a catalyst for significant amounts of private investment.

Central Asia

The EBRD is a renewable energy pioneer in Central Asia, where investment has increased on the back of significant policy reform.

In Kazakhstan, the government adopted a renewable energy law in 2013 following cooperation with the EBRD. In June 2015 the EBRD financed the first commercial-scale solar park and first privately owned renewable-energy generator in the country. The Burnoye Solar Plant is co-financed by the EBRD and the Clean Technology Fund (CTF) with loans of well over €80 million.

Also in June 2015, the Yereymentau wind project received the AmCham Award for “environment and safety”, an honour that the American Chamber of Commerce in Kazakhstan awards to outstanding projects every year.

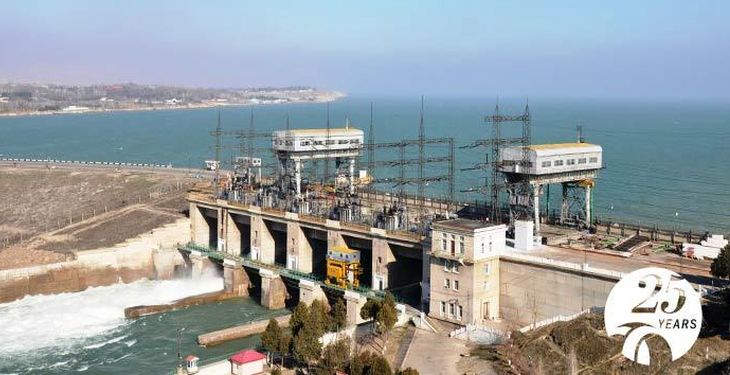

In Tajikistan, the EBRD has allocated a total of US$ 88 million – its largest financing in the country by far – to the modernisation and capacity increase of the Qairokkum HPP. The project includes an innovative mechanism to make sure the dam and power plant continue operations under a range of climate change scenarios.

The prestigious US Treasury Development Impact Honors Award recognised the Salkhit wind farm, the first large-scale renewables project in Mongolia, which came on-stream in 2013.

Nandita Parshad, EBRD Director for Power and Energy Utilities, says: “[The Salkhit wind farm’s] electricity will displace a generation of coal-fired plants, providing about five per cent of the nation’s needs from this clean, renewable resource instead. In time, other wind farms will follow.”

We are channelling over US$ 75 million to rehabilitate one of Tajikistan’s vital hydroelectric power plants – at the Qairokkum dam. The project is also supported by the Climate Investment Funds, UK and Austria.

Central and south-eastern Europe

The EBRD has funded investment programmes with commercial investors in wind power in Bulgaria, Poland, Romania and the Western Balkans. For instance, the Bank financed 12.5 per cent of Romania’s installed renewable energy capacity. After successfully launching the first privately owned wind farm in Montenegro, work is now under way on the first wind farm in Serbia.

Eastern Europe and the Caucasus

In Ukraine, the EBRD has financed the first solar plant in the country, as well as wind farms and biomass plants. An ambitious programme to rehabilitate the country’s powerful hydropower plant network, launched in 2011, has a volume of US$ 300 million.

In Georgia, the EBRD promoted private investment in the hydropower sector thanks to BSTL, and is working on the first-ever wind farm in the country.

Turkey

Almost half of the EBRD’s current portfolio in Turkey is in sustainable energy, including renewables. Since 2009 the EBRD has invested about €867 million in 29 renewable investment projects, including two of the country’s largest wind farms – Bares and Rotor.

Turkey’s significant potential for geothermal energy is a particular focus. In 2015, the EBRD extended a loan of US$ 200 million for the largest geothermal power plant (GPP) in Turkey (and the second-largest in Europe), Efeler. Previously, the EBRD financed six GPPs through Turkish commercial banks. Together with the Clean Technology Fund (CTF), the Bank launched a US$ 125 million initiative to provide finance and advice to private developers to help minimise risk in the early stages of projects. Late last year, EBRD took a 20 per cent stake in the renewable arm of Turkey’s Akfen Holding.