Clean energy investments have almost doubled the performance of fossil fuel energy stocks over the past year and a half, new figures have revealed.

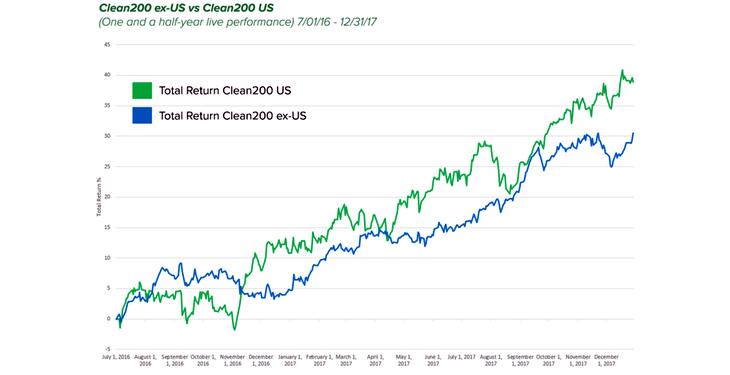

The Clean200 group, which includes the largest publicly traded companies making revenues primarily from clean energy, generated a combined return of 32.1% in the past 18 months.

That is compared to the 15.7% for the Clean200’s fossil fuel benchmark the S&P 1200 Global Energy Index, despite a general upswing in oil prices during that period. The report was co-authored by green media research firm Corporate Knights and non-profit As You Sow.

“Market forces continue to show that the new energy economy is not only a growth sector, but continues to outperform fossil fuel based energy,” said Andrew Behar, chief executive of As You Sow. “We are witnessing the ‘Great Transition’ that has been predicted.”

The outperformance is driven by companies involved in the provision of products, materials and services related to energy efficiency, according to Euractiv.com.

The top 10 companies on the Clean200 list include German manufacturer Siemens, car giant Toyota, electronics firm Panasonic and energy and automation company Schneider Electric. In December, Schneider signed up to the Climate Group’s RE100 initiative to source renewable energy and the EP100 initiative to double energy productivity by 2030.

China leads the way with 68 companies on the list, followed by the US (35) and Japan (21). In order to be eligible, a company has to have a least $1bn in market capital and at least 10% of its revenues deriving from clean energy as defined by Bloomberg New Energy Finance (BNEF).