With over 80 members around the world, the International Association of Oil and Gas Producers – IOGP – represents most of the world’s leading publicly traded, private and state-owned oil and gas companies, industry associations and major Upstream service companies. When we met in Bruxelles, few weeks ago, Mr. Francois-Regis Mouton – IOGP EU Affairs Director, spoke about Europe’s rising dependence on imports of oil and gas. At the same time, he noted that Europe is still an exploration hotspot, as it yields some of best E&P results globally! In this context, Romania could become net exporter, based on its over 200 bcm gas potential at the Black Sea, under the condition the country granted legal framework fit for purpose and stable for FIDs to be taken – interconnectivity, market liberalization, and stable taxation included.

Dear Mr. Francois-Regis Mouton, Romania is currently undergoing a complex and painful process of upgrading its fiscal and regulatory frameworks in order to encourage new investments, mainly in the offshore segment, but also in order to comply with a more interconnected European gas market. What are Romania’s prospects in terms of oil and gas production compared to other regions in Europe?

Dear Mr. Francois-Regis Mouton, Romania is currently undergoing a complex and painful process of upgrading its fiscal and regulatory frameworks in order to encourage new investments, mainly in the offshore segment, but also in order to comply with a more interconnected European gas market. What are Romania’s prospects in terms of oil and gas production compared to other regions in Europe?

While EU oil & gas production is in a slow but steady decline, Romania has the opportunity to reverse this trend become one of the biggest oil & gas producers in Europe. We know there are large resources, and probably many more to find in the future. Romania can also become a major energy hub in a region that could really use a more liquid energy market. Romania could well be a sleeping giant when it comes to oil & gas. Compared to other regions, the best could be yet to come; not many parts of Europe can say the same. The fundamental elements are in place; now it’s up to Romanians to make it happen.

After more than 150 years of exploitation, it seems that Romanian underground does still host enough hydrocarbons. What is, in general, mostly needed for getting access to these untapped resources? Is it technology, is it money, is it engineering know-how?

I’m always amazed at how technology allows us to do things we thought were impossible before. Just look at the shale revolution in the US! Know-how is also extremely important of course because without it, you can’t use the technology and access the resources. From that point of view, Romania’s long experience with oil & gas is a strong point on which to build the future. Finally, money is the ultimate enabler, and you could even say it’s a multiplier. This is where bringing in partners with the right financial firepower to take those risks and make those final investment decisions that can make a difference. But I wouldn’t worry too much about the money; if everything is set right, investors will come.

Romanian authorities are trying their best in order to maximize state revenues from the local O&G industry. What elements should the politicians take into consideration for minimizing the risk of chasing away the potential investors in the O&G sector?

The most important thing for all of us to take into consideration is that this is a global market. If you’re an investor, you will go where you have a good chance of producing. If you’re a policymaker, it’s in your interest to attract investors. Both need to work together to achieve a balance between their interests and make things happen. Otherwise it’s a lost opportunity for everyone: state, industry, society.

From a technical or administrative perspective, the key elements are a stable fiscal system, a market with efficient price signals, with infrastructure for exploration and production, but also transportation of oil & gas, and with operational regulations that are fit for purpose, taking into account industry standards and best practices.

With open and transparent dialogue between regulators, governments, operators and contractors, you create trust, stability, and facilitate investment over the long-term. This is why IOGP brought together industry actors from different parts of Europe in Bucharest a few months ago, to share their experience on how to put in place a successful framework for oil & gas exploration and production.

One of the studies you promoted some months ago showed that exploration and production in Europe remains competitive, with exploration cost per boe discovered dropping significantly since 2015. The success rate is has also increased in recent years, while the oil price raised, too. Under these circumstances, what kind of policies might be designed in order to encourage future production in Europe?

Producers need efficient access to markets, particularly for natural gas production where infrastructure such as pipelines and interconnectors are key. If we are locked into national markets which are not integrated with neighboring ones in the region, investment conditions are not going to be as attractive.

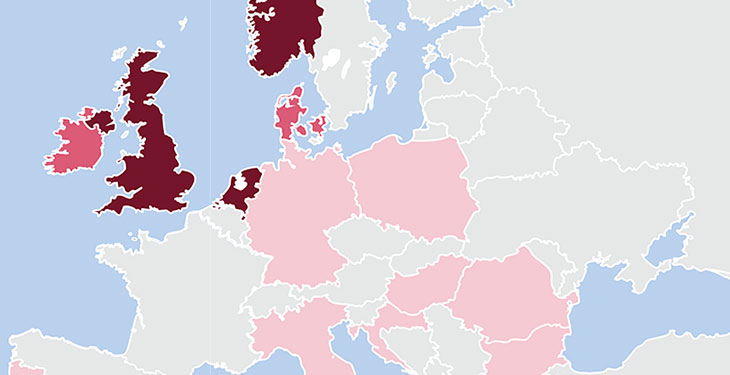

The development of flexible market arrangements such as gas hubs, as is the case in North-Western Europe, is also important, as selling into a hub is a very efficient option to commercialize gas discoveries. A number of the EU regulations, such as the Third Energy Package and the network codes, are designed to develop gas hubs in areas that don’t have them, and such regulation should be implemented before developing new regulations.

Moving out of regulated consumer prices is also important for Upstream producers, since regulated prices distort wholesale competition and therefore indirectly impact production. Price signals are a key factor in shaping investment decisions and promoting competition – and without competition, prices will be less favorable for consumers in the long run.

And finally, operational safety and environmental performance is the industry priority. Any changes to regulations or policy in these areas must be very carefully thought-through in order to avoid unintended consequences. Where changes are seen as necessary, there should be clear evidence of the need for doing so. We also strongly believe in the goal-setting approach to offshore safety, and would not want to see prescriptive offshore safety regulation being developed in Europe.

EU is more and more focused on targeting a greener economy and society; at the same time, almost half of its energy needs are met thanks to O&G resources. How can this tension be solved, in your opinion, for granting a sustainable future for the O&G industry?

First, we need to come back to the main objective, which is to reduce emissions. Then, we need to look at how we do this in an affordable way for European citizens, so that they can really take ownership of the transition in their country. We also need to take into account the European industry, so that their competitiveness is not jeopardized by policy choices and are able to remain in Europe. It’s not about opposing one group of technologies to another, it’s about cutting emissions wherever it makes sense, at the least cost. In the short term, we can switch from coal to gas in power generation. In the long term, we can use CCS and hydrogen, in which we have decades of experience and which will be crucial solutions to reduce industry emissions in sectors where we can’t fully electrify and use renewables.

Should we dismiss these technologies just because they are linked to oil & gas? We don’t think so, and we call on EU policymakers to use not just one or two but all cost-efficient measures at their disposal to reach our climate objectives. We can’t be ideological about this because at the end of the day, it’s consumers who will make the transition happen and if they can’t afford it, we will all fail collectively.

—————————————-

This interview firstly appeared in the printed edition of energynomics.ro Magazine, issued in December 2018.

In order to receive this issue of energynomics.ro Magazine, we encourage you to write us at office [at] energynomics.ro to include you in our distribution list. All previous editions are available HERE.

Dear Mr. Francois-Regis Mouton, Romania is currently undergoing a complex and painful process of upgrading its fiscal and regulatory frameworks in order to encourage new investments, mainly in the offshore segment, but also in order to comply with a more interconnected European gas market. What are Romania’s prospects in terms of oil and gas production compared to other regions in Europe?

Dear Mr. Francois-Regis Mouton, Romania is currently undergoing a complex and painful process of upgrading its fiscal and regulatory frameworks in order to encourage new investments, mainly in the offshore segment, but also in order to comply with a more interconnected European gas market. What are Romania’s prospects in terms of oil and gas production compared to other regions in Europe?