Romania’s natural gas production fell below 9 billion cubic meters (bcm) in 2020, to its lowest level since 1970, since when oil giant BP has been publishing its annual report on the global energy market and resources – “Statistical Review of World Energy”.

Against the background of relatively constant consumption of about 11 bcm per year, the share of imports is expected to increase. However, in 2019 and 2020, Romania only bought about 1 bcm of natural gas from Russia.

In the first half of 2021, however, Romania’s natural gas imports increased 3-4 times according to Gazprom data, which indicates a variation of 318% compared to the first six months of 2020. Romania remains one of the countries with the lowest imports of gas from the European Union, but without the exploitation of natural gas from the Black Sea, the outlook is clear: the share of imports in domestic consumption will increase. The BP report shows that the ratio between energy consumption and proven reserves (R/P Ratio) is 9.1. With reserves of about 100 billion cubic meters and a declining production (8.7 billion cubic meters in 2020), Romanian gas runs out in about nine years, at the current rate of extraction and based on current reserves.

An analysis in the offers of the main natural gas suppliers, made by E-nergia.ro, shows that the price of gas-as-commodity has doubled in the last 12 months, which is transferred to bills 50-60% higher for the households.

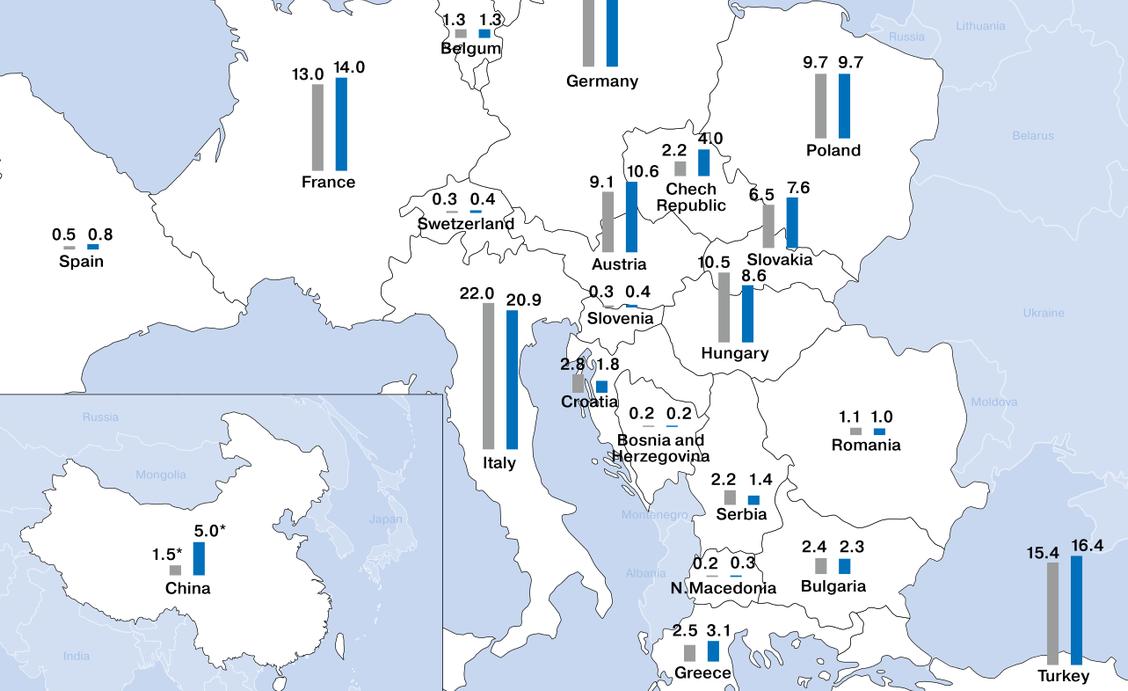

According to the Intelligent Energy Association, the first factor that contributed to the price advance is the gas supply program imposed on producers, the so-called Gas Release Program (GRP). The Intelligent Energy Association considers that it has made the price of natural gas in Romania at least 5% below the price in Eastern Europe (as traded on the Vienna Stock Exchange), starting with June 2020. “Thus, some suppliers understood that this program gives them the opportunity to make a considerable profit and they bought (cheap) natural gas from Romania and exported it to countries where the price was the one in Vienna (Hungary, Austria).” Exports of natural gas through medium and long-term contracts and short-term imports at (higher) spot prices have contributed to higher prices and imports.

Other elements invoked by the Intelligent Energy Association are the much higher demand than supply, the lack of market information that led to some precipitation of buyers, the change of gas routes in Southeast Europe, with the cessation of deliveries from Ukraine to Southern Europe.