Motto

“A dream you dream alone is only a dream. A dream you dream together is reality.”

John Lennon

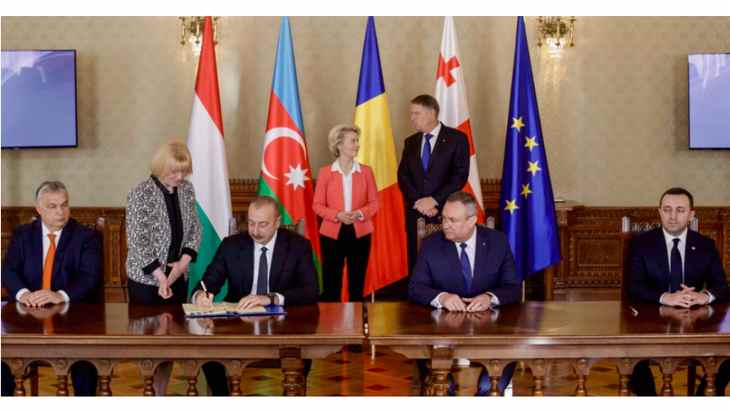

Weekends are for day-dreaming and last Saturday presidents and prime ministers from Azerbaijan, Georgia, Romania, Hungary and the EU showed the world how to pursue this otherwise solitary activity. With much fanfare, they signed an agreement about a new, sub-sea electricity line that would connect Azerbaijan via Georgia and Romania with Hungary. This short writing will highlight that this is a true EU project in one sense of the term only: it is a fairy tale in the tradition of Andersen, La Fontaine and the Grimm brothers. To refer back to John Lennon, it does not matter how many politicians are (day-)dreaming together, it is unlikely that this Azerbaijan to Hungary cable will be a reality.

The proposed electricity connection from Azerbaijan to Hungary could be sub-divided into five steps:

- Export of green electricity from Azerbaijan;

- Transit via Georgia;

- Transit under the Black Sea;

- Transit via Romania; and

- Electricity sold to Hungary

Out of the five steps, only one looks viable: the proposed undersea cable of 1,000 km would be the longest on Earth, yet this seems to be the least problematic out of the five steps. For the time being, Norway to UK (North Sea Link) cable is the world champion (around 721 kilometers) and adding an extra 300 kilometers or so does not seem to be a big engineering challenge. So many off-shore windfarms had been put into operation in Europe during the last ten years that a special branch of electric engineering is dedicated now to under-sea cables: both experience and expertise are available in the EU. To connect the Georgian beach with Constanța is only a matter of money – and loads of it: the initial estimate runs into the 8 billion euros region. Just to remember, the North Sea Link, completed in October 2021, cost 2 billion euros. Well, the extra 300 kilometers, plus inflation seem to triple the pro-km costs for the Black Sea project. Also, the draft feasibility study does not come cheap either: apparently, an Italian consultant firm has been paid over 2.5 million euros and the study is due in late 2023.

Potential problems and challenges regarding the other four points may be discussed under three headings:

- Practical

- Geo-political

- Regulatory

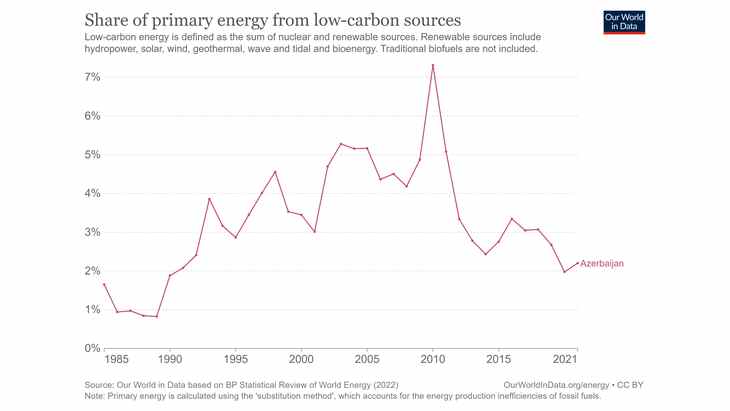

The practical point is simple and requires no energy-industry knowledge. There is NO green energy in Azerbaijan. As per the latest statistics, roughly 2% of all electricity generated in Azerbaijan is from “low carbon sources”; the rest is all from gas and/or oil. Apparently, there is a plan to join forces with Saudi Arabia (Bloomberg is referring to Acwa Power Co) to build, in a fast-forward way, RES generators in Azerbaijan.

Assuming that this RES-mania is successful, it is not clear how ‘green’ electrons would be separated from ‘dirty’ electrons coming from the local gas/oil-fired units. Electrons are following the rules of physics and not so much human-invented color codes (green to the new electricity line, dirty brown to stay in Azerbaijan).

Assuming that there is enough RES generation in Azerbaijan and the green electrons have found their way toward the Black Sea cable, the next hurdle would be cross-border capacity. Georgia tends to be electricity short and they are importing electricity from Azerbaijan. Especially so during dry seasons/years: around 75% of all Georgian electricity is coming from hydro stations or 75% of all generation is missing in a dry year, like 2022. The upper limit for this electricity import is the maximum capacity of the existing cross-border connection points. If extra RES electricity would be available in Azerbaijan, and extra cross-border capacity would be built (both of them big “if”), the natural and logical buyer for such electricity would be Georgia – why transport electrons to the other side of the Black sea, when Georgia is just around the corner?

The geo-political points are all about so-called “Frozen Conflicts”: disputed pieces of land, like Transnistria in Moldova. Over the territory of the ex-USSR, there are four Frozen Conflicts zones. Out of these, one is in Azerbaijan (Artsakh), and two in Georgia (Abkhazia and South Ossetia). It is up to Russia if and when such conflicts will be “defrosted”. The main moral from the Donbas region of Ukraine is that Russia tends to have problems with controlling such local warlords, once a conflict had been ‘de-iced’. It would require a special edition of investment bankers to lend billions of euros to a project that is involving two ex-USSR countries with three Frozen Conflicts zones that might turn into a Ukraine v2.1 disaster at short notice.

Finally, the regulatory issue is specific to the Romanian-Hungarian border. The EU had been supporting (some say, even forcing) the idea of market coupling in Central Europe for several years. Hungary joined the Czech Republic-Slovakia market coupling regime in 2012, and Romania was a relative latecomer to this show in 2014. The promise from the EU and the relevant electricity exchanges (HUPX and OPCOM) was that market coupling will promote effective competition, will increase liquidity and will enable the most efficient utilization of scarce cross-border transmission capacities in Europe. Although there is little (or no) evidence supporting any of the above claims (if anything, HUPX traded value is actually decreasing), the EU was pushing this market coupling idea to a new level. Hungary and Romania joined SDAC (Single Day-ahead Coupling) in June 2021. What does it mean for the Azerbaijan-Hungary proposed cable? Even if Azerbaijan would build new RES generation, even if the cross-border bottleneck to Georgia would be sorted, the SDAC algorithm would decide on a day-ahead basis whether the supposedly green Azeri electrons go to Hungary or stay in Romania. If the project developers would like to book monthly or annual capacity to avoid this technical SDAC problem, they will notice that financial options only are available from JAO (Joint Allocation Office – EU main cross-border auction platform). It is not possible to book physical transmission rights from Romania to Hungary, as of July 2022. In short, a physical cable might be built from Azerbaijan to Hungary, via Romania, but under the SDAC regime, there is no guarantee that Azeri electrons will ever reach Hungary.

I mentioned in the introduction above that the story of the Azerbaijan to Hungary electricity cable reads like a classic European fairy tale. It is a sad story about a multi-country project that should have been dismissed as “vivid dreams” during the early planning stage. Nevertheless, like any good European fairy tale, the final sentence here should read “… And they lived happily ever after”.

About the author Jozsef Balogh is a senior business developer for Axpo Solutions, Switzerland, with special focus on Central European and Ukrainian electricity, gas and CO2 opportunities. He had been active in the Central European energy industry in various roles since 1992. He has been especially active in Ukraine and Hungary.

Pingback: Telex: Orbán Viktor és az azeri zöld áram illúziója