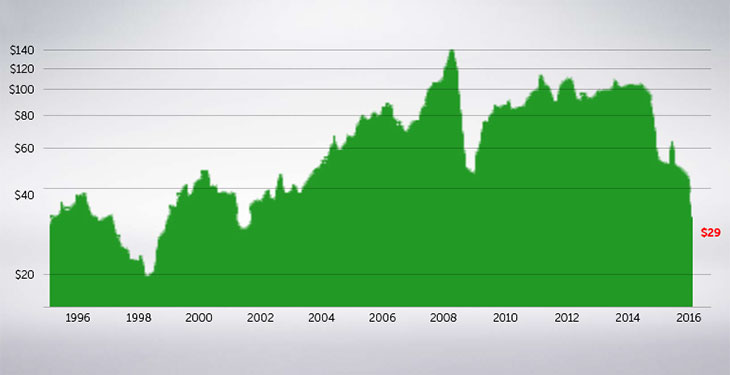

Brent crude, used as an international benchmark, fell on Monday as low as $27.67 a barrel, its lowest since 2003, before recovering slightly to trade at $28.17. On Friday, the price of US crude fell below $30 a barrel for the February Future contracts.

The analysts consider the new decline is due to the Western sanctions on Iran being lifted, after more than 5 years. “This means we will be seeing a bigger oil glut with Iranian crude exports coming back to the market,” said Phillip Futures analyst Daniel Ang, for BBC. Iran has the fourth largest proven oil reserves in the world.

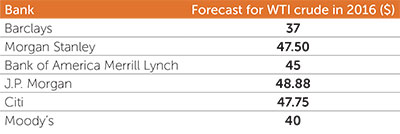

Last week, experts from Morgan Stanley evoked the possibility that oil price would go under $30 a barrel, because of the dollar appreciation against the other benchmark currencies. However, that’s not Morgan Stanley’s 2016 base forecast, as the bank expects crude to average $47.50 a barrel this year. The forecast is quite simmilar with those communicated by other four large international banks. Barclays is by far the most pessimistic bank when it comes to the outlook for oil, as the bank expects crude to average $37 a barrel this year.

All these scenarios count on a resurge of the price over $50 a barrel in the second semester. A powerful impact might have Russia, considers Ambrose Evans-Pritchard. In an article published in The Telegraph, the analyst reminds of the possibility that exports of the biggest Russian companies, Lukoil, Rosneft, and Gazprom among them, would decline by 6.4% in 2016. The oil-pipeline monopoly Transneft estimates a drop of 460,000 barrels a day, “enough to eliminate a third of the excess supply flooding the world”, The Telegraph notes.