The energy crisis of 2021-2022 was like a tropical tornado: unexpectedly hit, then went without advance warning, and done much damage to European energy sector, including trading. What did we learn from this experience? Will Europe be better prepared for the next, guaranteed-to-happen energy crisis? Right now, it looks like everything is just fine in the European energy sector, as if the energy crisis took a summer break. Although the Russians are systematically under-delivering their gas import agreements (roughly 10% of pre-war volume and 30% of the volume promised after the Stockholm arbitration award), yet there is too much gas in Europe. Some commentators expect negative spot gas prices as soon as EU storages are full (late August). No major new power station came online in Central Europe, yet electricity prices tend to be negative in some hours. The historic record (so far) was HUPX hour 15 on 2 July Sunday, euro minus 500/MWh (“only” euro minus 0.01/MWh in Romania). CO2 certificates are continuously trading in the Euro 90/ton region (triple the price level of 2021), but nobody seems to be much bothered about this anymore. This moment of normality should be used to look back and understand how the 2021 – 2022 crisis really started. This short writing will offer an alternative history of what really happened last two years, with a special focus on CO2 regulation.

All started with COVID

Although some politicians would like us to link high energy prices to EU sanctions and the horrible war in Ukraine, this narrative is simply false: European energy prices started to spike as from Q2 of 2021, several month before Russia would attack Ukraine. Why then? What happened? This story, like so many heavy stories of recent years, starts with covid. The USA and EU together committed cc euro 4,000 billion to post-covid recovery plans in late 2020 (Europe, through NextGenerationEU) and in early 2021 (USA). This number is incomprehensible to the average person: it is so enormous that its true size becomes obvious only when compared to something known. You have to add the GDP of Romania, Bulgaria, Serbia and Hungary to the GDP of Germany and you get roughly euro 4,000 billion. The real challenge in early 2021 was that this never-seen amount of money was looking for “safe heavens” – which, in the dictionary of investment banking means, minimum risk, maximum return. The usual suspects (London property, shares, gold, etc.) were all over-priced: too much money was chasing too few eligible targets. It is important to note here that one “darling” category of potential investment targets had been just down-graded to “no-no” status at exactly this time: oil industry. At the dawn of the European green revolution, when marketing terms, like zero carbon foot print, certified green energy, renewable generation, etc. were invented for mass consumption, banks did not want or did not dare to finance oil drilling, oil refineries and oil pipelines. It was only after the introduction of the EU sanction against Russians refined oil products (February 2023) that Europe realized that this anti-oil policy was perhaps not the best for a continent, where the largest share of primary energy consumption happens to be oil (cc 34%). European security of supply would be in a much better shape, had (some of) the post-covid recovery funds been spent on oil investments, especially on refineries (EU is refinery short, i.e. there is simply not enough refinery capacity to keep European cars going) and on any pipeline that would have offered an alternative to Druzhba oil transportation.

Big changes in the carbon market

Totally independent of the above post-covid recovery events, big changes were happening in the European CO2 sector in late 2020: the fourth trading phase of the European Emission Trading Scheme (ETS) was just about to start in January 2021. ETS is the biggest and oldest (launched in 2005) emission trading arrangement on Earth, which already badly failed once: in late 2007 the price of one quote was euro 0.01/ton, i.e. the system collapsed. It should be emphasized that it was pure coincidence that the above two events (i.e. announcement of post-covid funds and the start of EU ETS phase IV) happened at the same time. Yet without this coincidence, we would have a very different European energy sector today. This was the moment, when financial investors, looking for safe havens for the above mentioned post-covid funds discovered the EU ETS market. First they could not believe their luck: here was a financial product (no physical delivery, can be traded from any corner of Earth) that was lightly regulated (no trading license, like for gas or electricity) and traded via exchanges (no counterparty risk). Given that the EU was very keen to avoid another 2007-style EU ETS fiasco, which was more, than likely during the dark covid months (who would want to buy CO2 certificates during a lock-down?), the financial investors were in a position to dictate the new rules and regulation for EU ETS phase IV. The main changes may be summarized as follows:

- Free allocation of EU ETS certificates to be phased out,

- The number of certificates in circulation to be reduced annually (so-called “linear reduction factor”), CO2 banking to be abolished (i.e. no certificates from Phase III could be transferred to Phase IV), and the total number of EU ETS certificates issued to be re-confirmed by mid-May each year,

- Market Stability Reserve (2015) to be further strengthened, i.e. more certificates will go to reserve (withdrawn from market),

- External credits from the so-called Kyoto system (like Clean Development Mechanism) to be barred from Europe,

- The number of emitter sectors subject to EU ETS rules to be gradually increased (like, civil aviation), finally,

- Compared to electricity or gas, CO2 trading shall be lightly regulated.

The above set of new rules were fixed for a period longer than usual in European emission trading: Phase V of the EU ETS system will only start in 2030, the above regulation could not be reformed before this date.

Parallel with the above regulatory changes, the EU was actively selling the above arrangement to the general European public under the marketing slogan of “Fit-for-55”. And hence everything was ready to re-launch EU ETS trading, as a major financial product: on the one hand was unimaginable amount of post-covid recovery funds, on the other a financial product that was reformed to meet the special requirements of financial investors. It is an interesting question what happened to the interest of emitters and final consumers: i.e. the two categories who actually pay for the whole CO2 show.

What happened

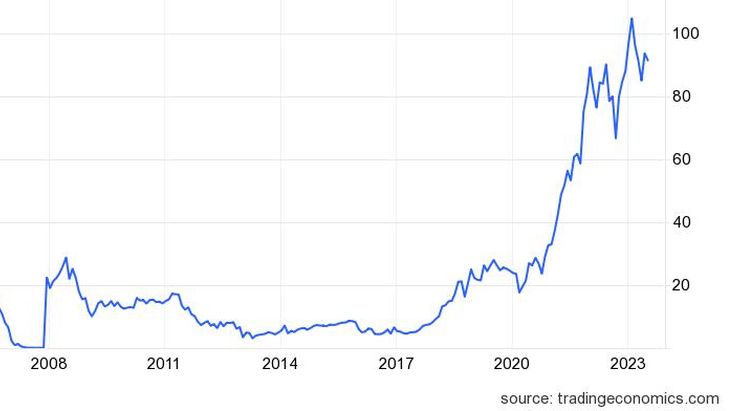

The result was spectacular. The price of EU ETS certificates tripled in 2021. By early 2022, financial investors held more certificates than all physical emitters (factories, power stations, fertilizers, etc.) together. Given this unfortunate set-up (i.e. emitters must buy missing CO2 certificates from financial investors), it is no surprise that EU ETS prices could never return to pre-2021 level: with minor interruptions, CO2 are on an upward trend in Europe ever since Q2 2021. The EU approved a set of rules that is guaranteed to keep EU ETS prices high: reduced supply (number of certificates reduced via linear reduction factor), increased demand (new sectors added) and “Fit-for-55” marketing euphoria (who dares to talk against a green Europe?) create an artificial “buy” market atmosphere.

No surprise, the miracle happened in early Spring this year: the price of EU ETS certificate was above euro 100/ton. As was mentioned above, the very same product was trading at euro 0.01/ton in November 2007. This is a 100,000% (one-hundred-thousand percent) price increase over sixteen years. No other traded commodity could ever match this performance.

But why is this saga so important from the point of view of energy trading?

The impact on energy trading

For EU power stations, EU ETS certificates are an input product, to be priced in the final price of electricity, just like fuel or maintenance, etc. As the price of CO2 certificates were going up and up during 2021, the price of electricity was automatically tracking the same upward movement. As electricity was getting more and more expensive, natural gas prices also started to go up: why should gas be cheap, when its alternative (electricity) is expensive?

And this was the moment (Q3 2021), when the Russians joined the show. They have discovered (with some help from certain EU investment banks) that they could make a double-kill here: big volumes of gas could be sold at high prices, if (and only if) CO2 prices remain on this upward trajectory. Several regulatory offices will spend many long years on finding out exactly what happened, but it is very likely that the Russians instructed their own Western European trading houses (now all defunct), plus gave orders to certain EU and Swiss investment banks to buy up EU ETS certificates. In trading jargon, this was the “bid-on” moment of CO2 trading (i.e. bids are coming in at the last trading price, pushing up prices further). Compared to doubled/tripled income from gas imports, the money spent on buying up CO2 was only a “rounding error” for the Russians.

Now two totally independent forces, financial investors spending the post-covid recovery funds and the Russians buy demand to push up the price of gas, together were creating bullish EU ETS fundamentals. And this kick-started the 2021 – 2022 European energy crisis: as was mentioned above, the horrible war and subsequent EU sanctions were only minor probabilities, when EU electricity and gas prices started their upward trend in Q2 2021.

To summarize, this last energy crisis would have been less tornado-like, had the EU reformed the EU ETS trading rules in a different way in 2020. Phase IV regulation is financial investor friendly, but the interest of emitters and final customers seem to be ignored. CO2 certificate prices are bullish and shall remain so until 2030 when the current trading rules will be revised. Electricity and gas trading only mirrored this upward price sentiment from the EU ETS sector in 2021 and this was the beginning of our latest energy crisis. Several interesting questions are waiting for an answer (like, what happened to the CO2 certificates the Russians held directly or indirectly, via EU banks?), but one point is for sure: the EU ETS trading regime is so calibrated now that the 2021 price boom (300% increase) may happen again, any time, without much warning – just like a tornado.

* The article originally appeared in the online publication www.vg.hu

About the author Jozsef Balogh is a senior business developer for Axpo Solutions, Switzerland, with a special focus on Central European and Ukrainian electricity, gas and CO2 opportunities. He had been active in the Central European energy industry in various roles since 1992. He has been especially active in Ukraine and Hungary.