Exxon Mobil Corp, the world’s largest publicly traded oil producer, said on Wednesday it expects earnings to more than double by 2025 to $31 billion, with crude prices CLc1LCOc1 at or above current levels.

It was the first time Exxon has ever given an earnings forecast so far in advance.

Exxon’s shares fell 1.4 percent on Wednesday morning to $75.13 alongside a dip in broader markets and oil prices.

Investors and analysts have bemoaned that the company’s returns have sagged below those of rivals Royal Dutch Shell Plc and Chevron Corp in recent years.

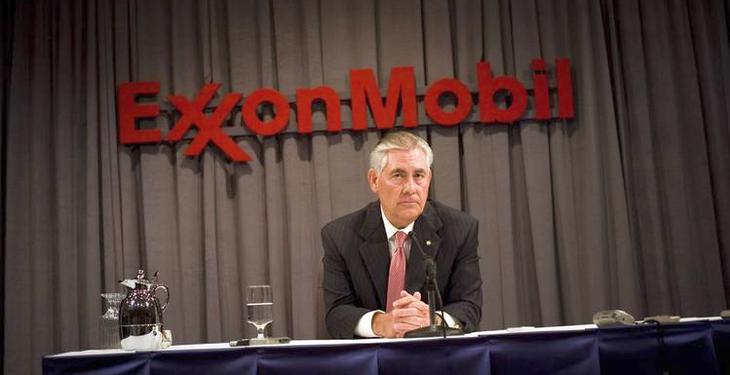

Exxon Chief Executive Officer Darren Woods, who took the helm in January 2017 after predecessor Rex Tillerson left to become U.S. secretary of state, said he was committed to being more transparent and improving results, according to Reuters.

Exxon said exploration projects in Guyana and the Permian Basin as well as refining and chemical plant expansions, should help boost earnings. Exxon reported an adjusted profit of $15 billion in 2017.

Exxon is also spending money to make money, with plans to spend $24 billion on capital projects this year, $28 billion next year and an average of $30 billion from 2023 to 2025. Peers, meanwhile, are cutting spending.

“If you look across our portfolio today, it’s the richest set of opportunities since Exxon and Mobil merged” in 1999, Woods said. “We see the full potential of the organization: significant earnings growth will improving return of capital employed.”

Production is expected to grow by about 1 million barrels of oil equivalent per day (boe/d), to about 5 million boe/d in 2025 as 25 projects come online, Woods said.