Today’s energy and natural resources (ENR) organizations may be unprepared to meet the ever-growing array of risks now present in the market, according to a recent review of ENR data collected by the Economist Intelligence Unit for KPMG’s Global ENR practice, and recently conveyed in a report entitled, ‘No paper chase: Transforming risk management at energy and natural resources companies’.

ENR organizations are already starting to lag behind

“ENR companies are at an inflection point in their risk management efforts,” said Michael Wilson, Partner, KPMG in the UK. “This data clearly shows that today’s ENR organizations urgently need to return to the basics and reconsider what they expect to achieve through their risk programs if they hope to keep up with the rapidly-changing risk environment in which they now operate.”

Falling behind the risks

The review of the data found that – while risk management continues to be a high priority for ENR executives and Boards – the management of these risks is not advancing as fast as the threats that they face and companies are, therefore, at risk of falling short in important areas.

The challenge is how to keep the Board and top management informed about top risks

Indeed, the data shows that ENR organizations are already starting to lag behind. Less than two thirds of respondents said that they ‘often’ or ‘constantly’ build risk management into their strategic planning decisions; only 14 percent of respondents said they had a formal risk appetite statement; almost half admitted to not doing an annual bottom-up risk assessment; and more than one third said that their risk management function relies on a self-assessment from the business units, rather than a centralized risk function.

“Oil and gas companies have always invested in risk management activities to address those risks that are function-specific, such as exploration risks, production risks and financial risks,” says Paolo Mantovano, Partner, KPMG in Italy. “The challenge is how to get all these risk management initiatives integrated into a common framework to make sure that the Board and top management are kept informed about top risks and mitigating plans, in order to strengthen decision-making.”

Understanding the challenges

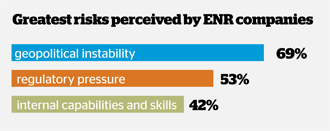

According to a review and analysis of the results released today by KPMG International, more than two thirds (69%) of ENR respondents see geopolitical instability as the greatest threat to the industry, while more than half (53%) also cited regulatory pressure as a major threat. Regulatory uncertainty is particularly keen for those ENR organizations venturing into new countries or unstable regions.

In particular, the report finds that ENR executives are concerned about their internal capabilities and skills in important risk management areas. For example, 42% said that a lack of skills was the main obstacle slowing the integration of their risk and control functions, while almost half (47%) said that skills would need upgrading in order to improve their organization’s adherence to regulation.

When it came to risk management, ENR respondents noted less confidence in their Boards than other industry sectors surveyed in the research. Just over a third (37%) of respondents suggested that their Boards had a strong enough understanding of the issues to effectively communicate risks. And, only 42 percent thought that their Boards fully appreciated the importance of the risks they were facing.

“It comes down to a question of what skills and resources have been dedicated to the enterprise risk management program,” notes Wilson. “I’m not sure that ENR companies have done a good job of understanding the expectations of internal and external stakeholders with regard to risk management and building the process and skills to meet those expectations.”

Gaining value from investments

One of the bigger challenges slowing investment into risk management functions and capabilities within the ENR industry comes down to a lack of consensus between the Board and executives about the goals of their program and the return on their investments. According to the data, almost a quarter of ENR organizations have no means of measuring the return on their investment into risk management at all. In addition, a third are only focused on reviewing past events to assess the effectiveness of their risk controls.