Nicolae Turdean has been appointed new General Manager at Cupru Min SA and he took over his new role on 15th of July 2015. Nicolae Turdean follows Dorel Tomuş, and assumes as his main priority the consolidation of the company. Since 2012, Cupru Min SA recorded over 32 million euro in turnover, anually, and over 12 million euro in cumulated profit.

Nicolae Turdean has previously held various positions within NAMR, Ministry of Economy and Ministry of Public Finances. For two years (2010-2012) he was a consultant for World Bank, with responsabilities on management of mineral resources in Uganda. In 2005, he participated to the drafting and negociation of the second loan the World Bank granted to Romania for closing its mines. For many years Nicolae Turdean was part of the World project The Mine Closure and Social Mitigation Project in Romania.

There is no question about the privatization Cupru Min, told us Nicolae Turdean in an exclusive interview. “For now the company’s position must be strengthened. We need to see how much of the profit is due to the company in the recent years and how much is a favorable context,” said Nicolae Turdean. “Now we are on a downward trend in the price of copper on the international sector and we need to see what cost reducing valves we can identify.”

For now the company’s position must be strengthened. We need to see how much of the profit in the recent years is due to the company and how much is a favorable context, Nicolae Turdean.

“Cupru Min managed to purchase some high performance machines in the quarry sector, and now we have to see what solutions exist, in order to increase efficiency and reduce costs in the processing area,” explains Nicolae Turdean.

“The investment plan for this year was quite generous,” notes Nicolae Turdean, but after a few good years with high copper prices, currently at a price of $ 6,000, Cupru Min is on break-even. However, there is no question of layoffs. “On the contrary, it may require new employment, since new machines were purchased and periodicaly there is an extra line working in preparation.”

Cupru Min is vulnerable to two potential risks coming from highly volatile markets: the leu-dollar or the price of copper at the London stock market.

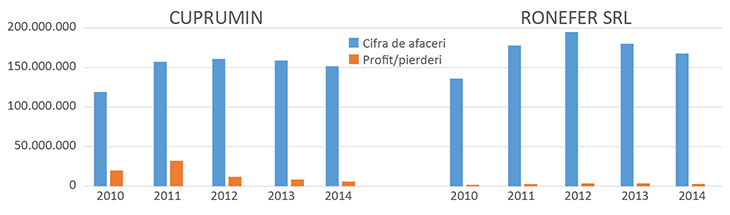

Yes for years now, Cupru Min sells its entire production of copper concentrates to the same company, Ronefer Voluntari S.R.L., owned and operated by Maria Gheorghe. According to www.zf.ro, Maria Gheorghe was an official in the Ministry of Metallurgy, and then until 2000, an employee of Conef. In the recent years, Ronefer consistently recorded a higher turnover than Cupru Min, but with modest profits: in 2014, on a turnover of almost 170 million lei, Ronefer had a profit of nearly 3 million lei.

Cupru Min S.A. owns 60% of Romania’s copper reserves, and from 2008 to 2013 it was put up for privatization several times and in different formulas. At the end of 2014, the company had over 500 employees and a net profit of 5.5 million lei.