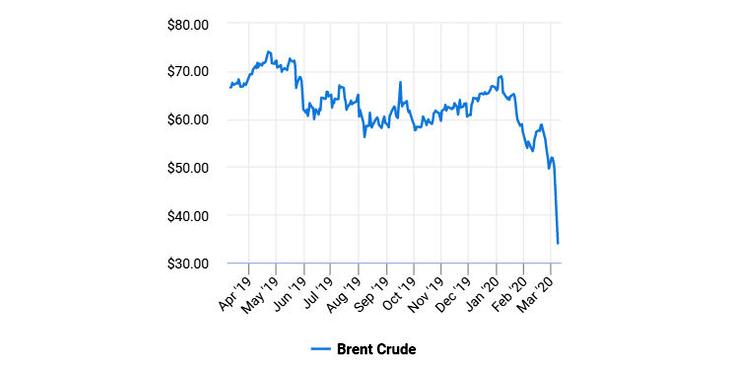

Oil prices plunged 30% in early trading after OPEC’s failure to strike a deal with its allies regarding production cuts caused Saudi Arabia to slash its prices as it reportedly gets set to ramp up production, leading to fears of an all-out price war.

International benchmark Brent crude futures plummeted 30% to $31.02 per barrel, its lowest level since Feb. 2016. U.S. West Texas Intermediate crude dropped 27% to $30 per barrel, also its lowest level since Feb. 2016. WTI is on pace for its worst day since January 1991 during the Gulf War, and its second worst day on record.

At about 11 o’clock, the declines tempered to near $ 32.6 per barrel for the WTI reference (-22.34%), respectively $ 36.08 per barrel for the Brent reference (-20.30 %).

“This has turned into a scorched Earth approach by Saudi Arabia, in particular, to deal with the problem of chronic overproduction,” Again Capital’s John Kilduff said. “The Saudis are the lowest cost producer by far. There is a reckoning ahead for all other producers, especially those companies operating in the U.S shale patch.”

On Saturday, Saudi Arabia announced massive discounts to its official selling prices for April, and the nation is reportedly preparing to increase its production above the 10 million barrel per day mark, according to a Reuters report. The kingdom currently pumps 9.7 million barrels per day, but has the capacity to ramp up to 12.5 million barrels per day.

On Saturday, Aramco slashed its official selling price for April for all its crude grades to all destinations, after OPEC’s oil supply cut pact with Russia fell apart on Friday. Sources quoted by Reuters said that April’s production will be significantly higher than 10 million bpd, possibly closer to 11 million bpd. Saudi Arabia has been pumping 9.7 million bpd in the past couple of months.

The Organization of Petroleum Exporting Countries and allies outside the cartel (OPEC + Alliance) have failed to reach an agreement on reducing production to offset the economic effects of the coronavirus epidemic (Covid-19), and the quotation of the North Sea Brent oil barrel dropped 7.30% on Friday to $ 46.34. OPEC proposed reducing oil production by an additional 1.5 million barrels per day in the second quarter of 2020. The 14 OPEC member states and the ten OPEC + Alliance countries, dominated by Russia, have failed to reach an agreement on further reductions. nor about the extension of the previous reduction of oil production by 2.1 million barrels per day, decided in December.