The gas year begins on October 1 and ends on the same date of the following year, and it consists of two seasons; the first 6 months represent the cold season, and the last ones, the warm season. Given the significant share of natural gas consumption for heating in the total consumed during a gas year, the general consumption during the cold season is significantly higher than the volume consumed during the warm season. At the same time, the consumption registered in the 6 months of the cold season is covered in part with natural gas extracted from deposits, with additional costs resulted from the storage process.

It is thus understood why the trading price of natural gas delivered in the cold season is as a rule higher than that for natural gas delivered in the warm season. This aspect mathematically determines a lower trading price of natural gas with delivery throughout the gas year compared to that delivered strictly during the cold season.

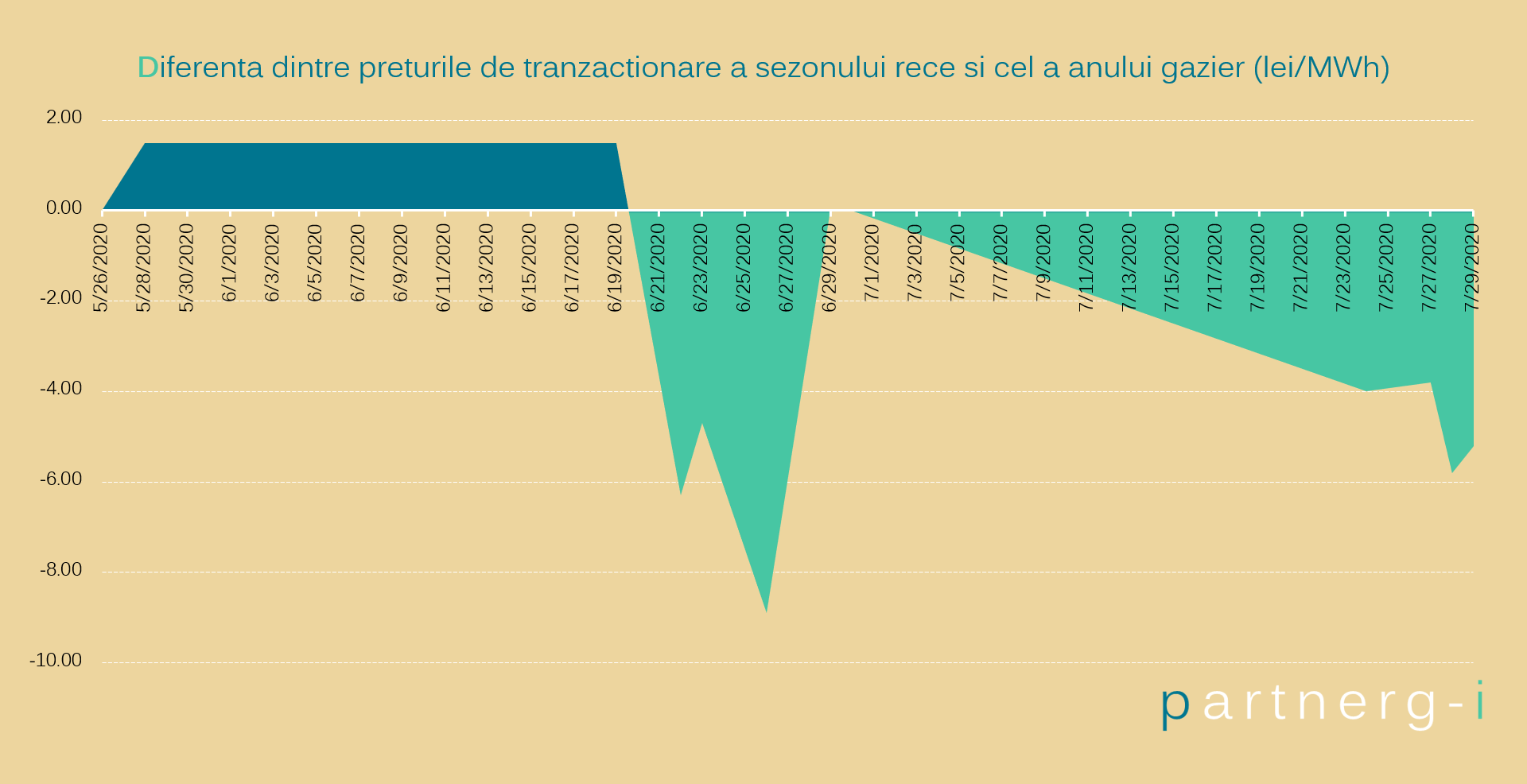

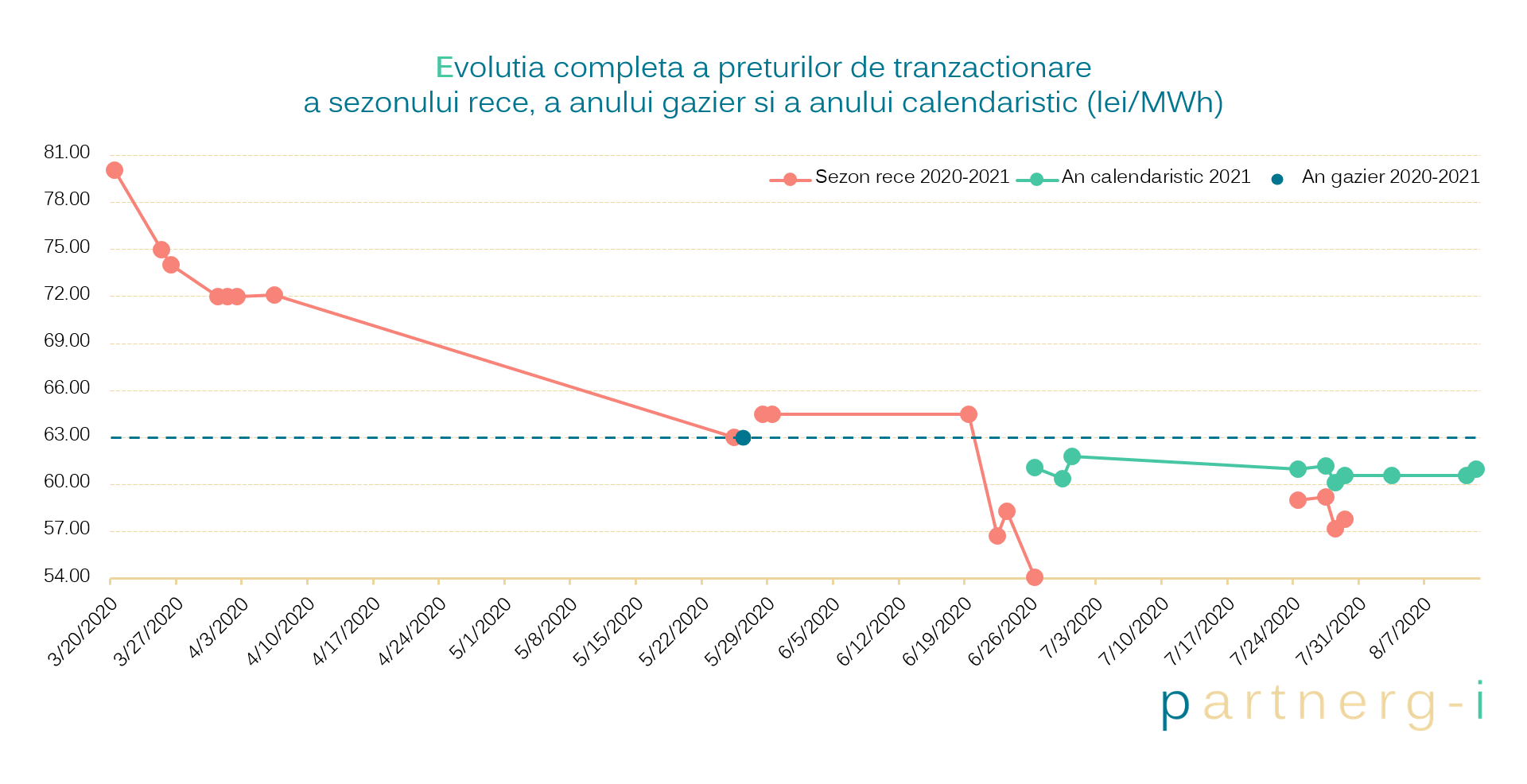

Well, looking at the data an apparent anomaly in wholesale gas trading prices and, to a large extent, in the prices for the gas supplied to final consumers become visible: natural gas delivered in the cold season seems to be cheaper than the level at the whole gas year, as for the latter there is only one local reference. “In the context of a sole transaction for the product with delivery between 01.10.2020 and 01.10.2021, corroborated with the lack of recent quotations, it results that the price for the period of the cold season, 01.10.2020-01.04.2021, is lower. Even the price for the calendar year 2021 is apparently lower than the price for the 2020-2021 gas year”, notes Theodor Livinschi, the founder of the consulting company partnerg-i.

He recommends to industrial consumers, whose contracts for the supply of natural gas expire on 01.10.2020 (30.09.2020), to request offers from suppliers both for the usual period of 12 months and for the period 01.10.2020-01.04.2021. Theodor Livinschi’s argument is that “the warm season, for which we do not yet have price references, cannot be more expensive than the cold season, as it now results from purely mathematical calculations. I estimate that with the beginning of the 2021 warm season approaching the price will be lower than that for the cold season”.

Theodor Livinschi considers it opportune to evaluate fragmented contracting of the period 01.10.2020-01.10.2021 (30.09.2021), because the value of the weighted average of the two supply prices of the natural gas molecule – the first contracted in this period for the first 6 months and the second subsequently contracted for the remaining 6 months – will be less than a price contracted this period for all 12 months.

“We make sure that the services we provide do not cause an additional expense. The benefits we bring to our partners in terms of electricity and natural gas costs outweigh the price of our services themselves. We integrate easily in a budget for commodities, built based on the conventional contracting of the supply of electricity and natural gas”, explains Theodor Livinschi.

ALSO READ Rising prices can be managed with openness to new solutions

Currently, the low liquidity of the natural gas reference products, but also the periods without transactions or even without offerings, prevent partnerg-i from delivering the service of Development of the acquisition strategy for the natural gas. This is the only service provided only for electricity, as all the other 4 services address both categories of energy commodities: Monitoring and market reporting, Optimization of existing contract and guidance, Selection and acquisition process and Contract development.