The 15% of ROMGAZ were sold for 1.7 billion lei (382.8 million euros) in the IPO of the largest Romanian privatisation on the capital market, which assesses the company at about 2.552 billion euros . This value is consistent with analysts who expected a Price Earning Ratio of over 9, well above 7,5, the average of selling prices offered by similar companies in Central Europe and East at 7.5.

Meanwhile, the insatiable appetite of the retail trancge, that oversubscribed more than 18 times, led to an increase tranche offered to retail investors at 20% of total, while large shareholders preferred to buy 60% of global depository receipts in London (GDR) based on ROMGAZ shares, at the expense of BSE large tranche.

On the track dedicated to small investors in the local market demand was pushed to 1 billion euros, even if the “crown jewel” of the Romanian economy recorded in the first nine months sales revenue of 2.58 billion lei, down 10%.

Romania finally come to the attention of global investors

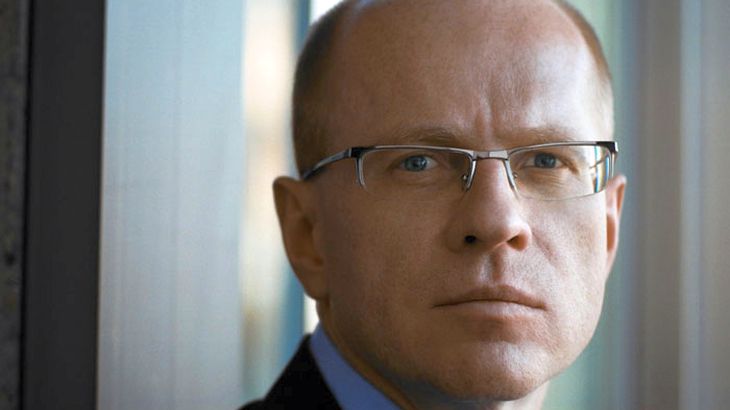

With Romgaz IPO, the Romanian capital market enters in the global stage, says the CEO of Bucharest Stock Exchange (BSE), Ludwik Sobolewski.

“At BSE we are proud and happy to know how many Romanian investors decided to take part in this historic project. BSE position has always been that local demand for Romgaz shares should not be underestimated when it was conceived the plan for this important transaction. Now we are sure that the local demand consists of individual and institutional investors in Romania”, said Ludwik Sobolewski.

Foreign institutional investors have taken 60% of the offer and the price was fixed at 30 lei per share, near the top of the range established, resulting in a cost of 9.25 dollars for GDR sold on the London market.

“We are now at a time of strategic importance for this transaction. Our position has always been that we shouldn’t follow superficial opinions or we to fit into stereotypes, according to which institutional investors would like to take just GRD, marketable only outside of Romania. No stereotype should be admitted when talking about the interests of Romanian capital market, the Romanian economy and the safety of local and international investors”, said Ludwik Sobolewski in the bid closing evening.

He also said that “an efficient and healthy capital market needs liquidity concentration. Local investors, both individual the institutional ones, need their international counterparts. They need them here, in Bucharest, on the Bucharest Stock Exchange. The quality of price formation mechanism largely depends on their presence. In addition, the international investors need the presence of local investors. It is crucial for each investor group separately and all together. “