UPDATE 28 MARCH: Following the publication of the analysis below, NAER issued a document to energynomics.ro editors to further specify the mechanism that ensures a fair price for electricity consumers served by providers of last resort. ANRE arguments can be read here.

Andrei Covatariu

The adoption of a system that will allow a step-by-step liberalization of energy prices has proved to be an inspired measure, as Romanians would not have been ready for a sudden, direct shift to a free market. The ongoing debates in the Romanian society on vulnerable consumers emphasize just that.

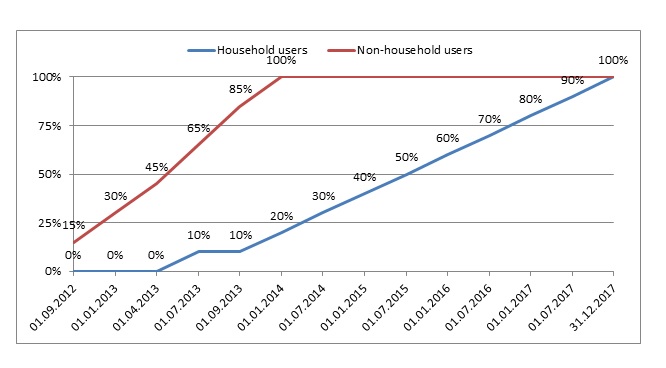

By comparison, the authorities in Bulgaria opted for a full liberalization of the energy market in 2016. Although about 30% of Bulgaria’s population can come under the definition of vulnerable consumer, the authorities preferred this option, in order to avoid a recurrence of past protests, caused by the increase of the energy price, actions that resulted in February 2013 in the resignation of the Boyko Borissov Government. The liberalization effects in Bulgaria will most likely be visible in the following period. It is important to remember that in June 2012, the Romanian authorities released the official calendar of liberalization of energy prices, as shown in the chart below:

Until full liberalization, the tariff perceived from households is to be composed of regulated prices and quantities (by ANRE) and CPC (competitive market component), which was approved by ANRE and represents the acquisition of energy by every supplier of last resort from the competitive market. At the end of the liberalization process, the CPC percentage was 100% of the energy cost in the invoice, which translates into a non-regulated energy price.

The process just described has unfolded till January 1 2015, when ANRE came up with a system of energy acquisition for CPC exclusively. Therefore, starting from the second quarter of 2015, this component started to be purchased after new rules. The motivation was the elaboration of a new “transparent and competitive mechanism of acquisition”.

The proposal was quite simple. For every quarter, the suppliers of last resort (those who have household consumers) were obliged to send ANRE a forecast of volumes and profiles of these clients. The aggregation of all data from the suppliers of last resort was going to establish the demand curve. ANRE would then set the type of products which were going to satisfy these needs and the maximum prices from which the auction would start. The energy producers were going to respond, depending on price and preferences, to the offers, establishing the supply curve. The auction implied the step by step decrease of prices, the auction being declared closed when all the requested energy quantity was traded.

An overview of this mechanism shows a semi-regulated process, with suppliers providing the quantities and profiles of their customers, and being unable to offer an electricity price. Therefore, the demand curve is set before the start of the auctions and can’t be later modified. Hence, the final transaction price is decided only based on the producers’ offer – that is, of those who choose to bid in auctions. Although the name of this component continued to be the Competitive Market Component (CPC, in Romanian), one cannot say that its price derives from a competitive acquisition process, which should be the suppliers’ responsibility.

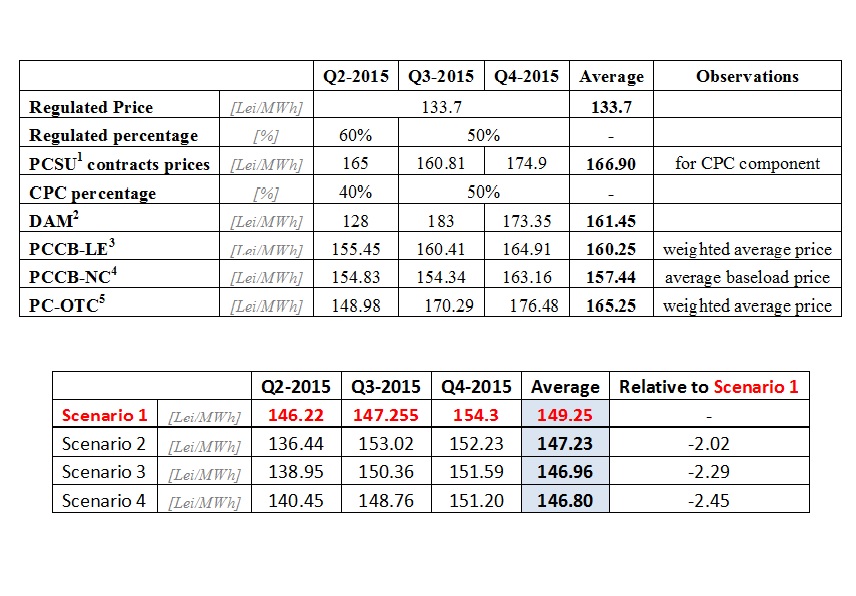

In 2015, the producers chosen by ANRE to cover the energy needs for the regulated market were Hidroelectrica – which participated with 4.16 TWh at a price of 120.2 Lei/MWh – and Nuclearelectrica – 2.25 TWh at 158.6 Lei/MWh. Therefore, ANRE set a total quantity for the regulated component of 6.4 TWh, at an average price of 133.7 Lei/MWh.

Moreover, according to the liberalization calendar, the percentage of the energy power at a regulated price was, in the first half of 2015, 60% (with 40% CPC), while in the second half the prices had equal percentages.

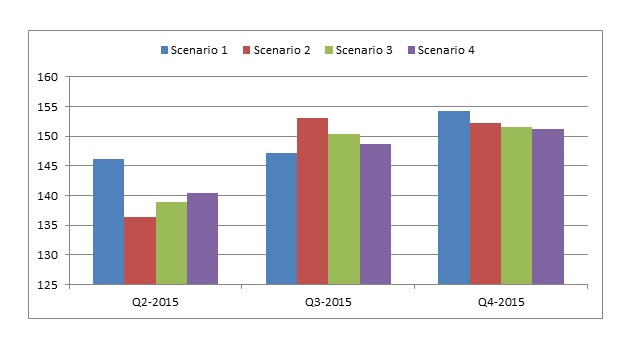

The data below propose several working scenarios of energy acquisition for CPC, for April – December 2015 period (Q2, Q3 and Q4) from the energy markets supervised by OPCOM. I offer a comparative analysis of the final prices of acquisition from every scenario (composed by regulated prices and competitive ones), with those recorded in the past year (2015). An overview of these scenarios is presented in the next table: The first scenario is, in fact, the actual scenario, which was pursued in 2015. Prices were established by regulation (60% in Q2, 50% in Q3 and Q4) and by the result of CPC auctions. In the second case, the same regulated prices were taken into consideration, but for CPC it was considered a mix of 50% spot prices (DAM) and 50% future products (the average price recorded on OPCOM markets).

The first scenario is, in fact, the actual scenario, which was pursued in 2015. Prices were established by regulation (60% in Q2, 50% in Q3 and Q4) and by the result of CPC auctions. In the second case, the same regulated prices were taken into consideration, but for CPC it was considered a mix of 50% spot prices (DAM) and 50% future products (the average price recorded on OPCOM markets).

The third scenario, similar to the second one, implied CPC to be established by 75% futures and 25% spot market, while the fourth scenario follows the same algorithm, but the spot market percentage dropped at only 10%. The supply companies’ strategies are different, but most of them follow those simulated in scenarios 3 and 4. It’s obvious that a strategy based on acquisition of futures would have been more advantageous (except for Q2), in comparison with the spot market. The exposure on the spot market involves a series of risks to participants; hence market players tend to hedge their needs in advance, step-by-step. The results of this simulation were somewhat predictable:

It’s obvious that a strategy based on acquisition of futures would have been more advantageous (except for Q2), in comparison with the spot market. The exposure on the spot market involves a series of risks to participants; hence market players tend to hedge their needs in advance, step-by-step. The results of this simulation were somewhat predictable:

- The price average by quarter, for each scenario, reveals that the 2015 closing prices for CPC auctions led to a final price of acquisition higher than if the suppliers would have participated freely in transactions (be they futures or spot).

- The only period in which the prices of futures or spot products were above the value of the auctions closed on PCSU is Q3, which corresponds to a summer drought, when the participation of hydro producers, in particular, but also that of other renewables was much lower. Therefore, prices went up and the energy for that period exceeded the PCSU price threshold.

- Moreover, the prices of futures or spot products in Q4 2015 was lower than the one closed on PCSU; but the most shocking difference can be noticed in Q2, period which corresponds to an overproduction of Porțile de Fier hydro power plant.

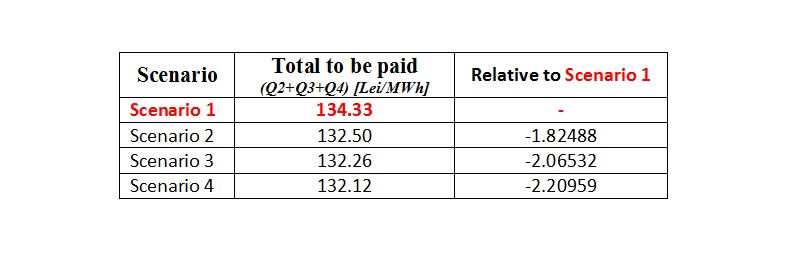

The average economy which households could have made in scenarios 2-4 is approximately 2.25 Lei/MWh. This value transposed, for instance, in the green certificates’ value of invoices, could have allowed the absorption of an extra 6.5% of Green Certificates, with the same money paid (the impact would have reached 37.25 Lei/MWh, instead of 35 Lei/MWh, which was the case in 2015).

Also, the situation in which we simulate a quarterly consumption of 0.3 MWh doesn’t substantially change the economy the households would have gained either: Readers of this analysis may point out that, in a case where the specialized market for CPC had not existed, then producers would have sold the same quantities on future and spot markets, while the consumers (via their suppliers) would have bought the same quantities from these platforms. It needs to be mentioned that in this special situation (in which the demand curve shifts with equal rates from the supply curve), the closing price remains the same.

Readers of this analysis may point out that, in a case where the specialized market for CPC had not existed, then producers would have sold the same quantities on future and spot markets, while the consumers (via their suppliers) would have bought the same quantities from these platforms. It needs to be mentioned that in this special situation (in which the demand curve shifts with equal rates from the supply curve), the closing price remains the same.

Since markets of any kind aren’t always pure mathematics, the effect on prices can’t be determined accurately. The analyses followed this scenario. Moreover, acquisitions made on other energy markets like intraday (which is generally a bearish element, of a decreasing market), balancing market (generally, a bullish element, of an increasing market – although the strike price on this market is often lower than the DAM) or different moments of the year in which the suppliers chose to buy the future products (which can be both bullish and bearish) were not taken into consideration. I believe the premises mentioned above would have had, in general, a neutral impact on closing prices.

The bizarre situation that can occur on January 1, 2018 is that of a fully liberalized market (0% regulated price by ANRE) with a percentage of 100% CPC, component which households suppliers are still obliged to acquire from a market which does not allow competition. Moreover, although at the specified date we will discuss about a liberalized market, due to PCSU acquisition, it can’t be talked about competition, for the prices will be the same.

Futures refer to standard energy products, traded on medium or long terms, on different OPCOM markets. But “futures” is a word borrowed from finance and financial markets. “Futures” does not resonate with OPCOM’s mechanisms either, since the Romanian operator does not have financial products, due to the limited legislative framework – another sign of a competitive market in progress.

Andrei Covatariu is and EPG Afiliated Expert, has a bachelor’s and a master’s degree in Nuclear Engineering at Politehnica University of Bucharest, as well as a master’s degree in Business Management from the Bucharest Academy of Economic Studies. At the moment he is a PhD. candidate, studying management of the national power system, at the Academy of Economic Studies.

——————–

This material was originally published on www.enpg.ro. Energy Policy Group (EPG) is a Romanian nonprofit, independent and non-partisan think-tank specializing in energy policy, market analytics and energy strategies. EPG’s regional focus is Eastern Europe and the Black Sea Basin, yet its analyses are informed by wider trends and processes at global and EU levels.