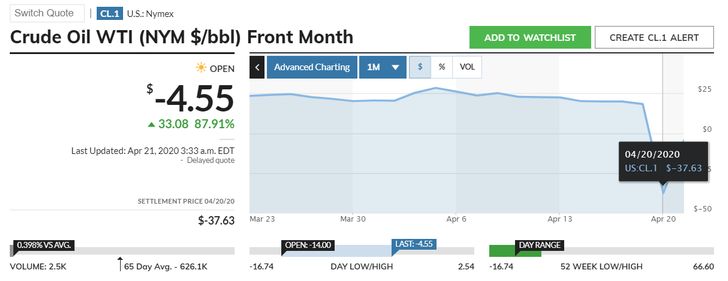

The price of oil has entered the negative territory on the US market, in the context of the wide reduction of the demand caused by the coronavirus pandemic and due to the depletion of storage spaces in the US. On Monday, at the end of the trading session, WTI contracts with delivery in May were minus $37.63 worth, the lowest level since NYMEX opened oil futures in 1983. Negotiation of contracts with delivery in May ends on Tuesday, and this fueled selling mainly by large investment funds active in commodity markets.

A relevant example is the USO (United States Oil) ETF, which attracted $ 1.5 billion in funds last week from investors betting on oil prices to recover soon. However, as prices entered the negative territory, investors rushed to find buyers able to get physical deliveries, before the May contracts expired. A WTI barrel for delivery in May traded near -4.5 dollars, on Tuesday, 11 am, Romanian time; earlier the Asian trading had lifted the prices to slightly over $ 1 a barrel.

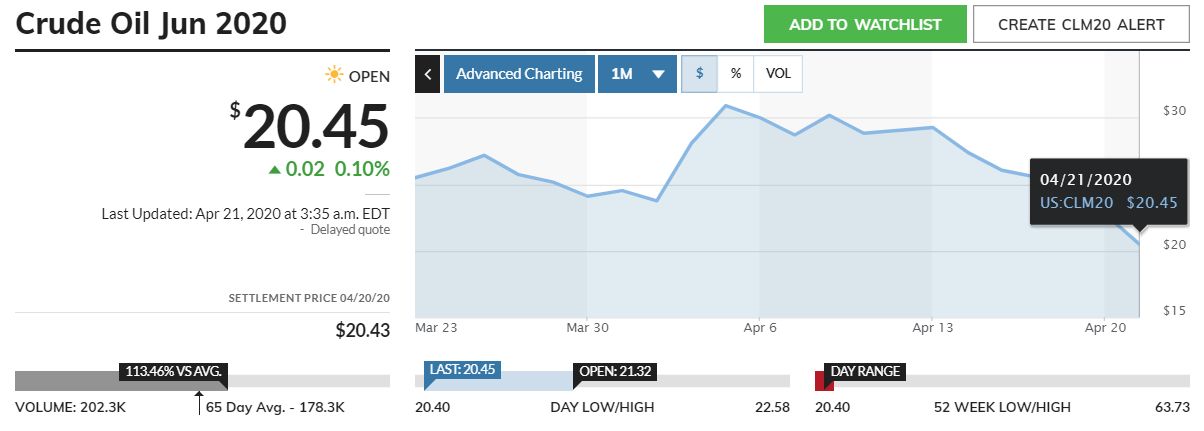

As of Wednesday, the market benchmark will be given by futures contracts with June deliveries – on Tuesday morning they traded at just over $ 20, close to Monday’s closing level.