Europe installed 17 GW (11 GW in the EU-27) of new wind capacity in 2021, while in Romania there were no installations. This is not even half of what the EU should be building to be on tract to deliver its 2030 Climate and Energy goals, says the latest WindEurope study consulted by Energynomics.

Among the 2021 SEE regions’ champions were Turkey, with 1,400 MW and Ukraine, with 359 MW. Poland installed 660 MW, while Croatia installed 187 MW and Bulgaria- just 2 MW. Therefore, Romania’s capacity stays the same, at 3,029 MW, which covered about 11% of demand in 2021. According to WindEurope’s expectations, Romania will keep this pace, with just 3 GW of installed capacity also in 2025-26, which, according to Energynomics local market sources, may be a wrong number, as new projects will be financed through EU funding facilities.

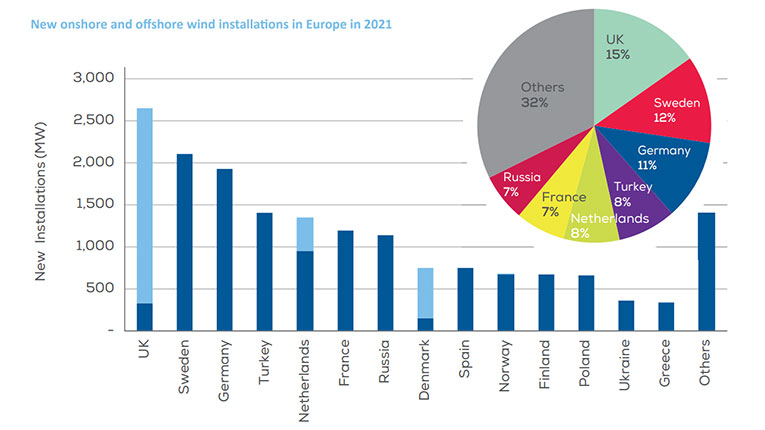

In 2021, about 81% of the new wind installation in Europe last year were onshore wind, says WindEurope. Sweden, Germany, and Turkey built the most onshore wind. The UK had the highest total new wind installations, because they account for most of the new offshore wind installations. Europe now has 236 GW of wind capacity.

”We expect Europe to install 116 GW of new wind farms over the period from 2022-2026. Three quarters of these new capacity additions will be onshore wind. We expect the EU-27 to build on average 18 GW of new wind farms between 2022-26. They need to build 32 GW a year in order to meet the EU’s new 40% renewable energy target”, says WindEurope.

In 2021 new wind installations in Europe amounted to just 17.4 GW (14 GW onshore and 3.4 GW offshore) as permitting bottlenecks and global supply chain issues continue to delay the commissioning of new wind farms. While 2021 stands as a record year for installations (surpassing the 17.1 GW figure for 2017), they were 11% lower than forecasted.

The countries with the most new installed capacity were the UK, Sweden, Germany, Turkey and the Netherlands in that order. Sweden installed most new onshore wind (2.1 GW). The UK installed most new offshore wind (2.3 GW).

Germany will be Europe’s largest wind market thanks to the strong expected performance of its onshore market over the next five year (19.7 GW) and rising offshore installations (5.4 GW). Other markets with significant new installations over 2022-2026 will be the UK (15 GW total), France (12 GW), Spain (10 GW) and Sweden (7 GW).

Despite higher annual installation rates, Europe will not install anything like the onshore wind volumes it needs to reach its energy and climate targets. Europe would need to install 25 GW of new onshore wind on average per year over the period 2022-2026.

A similar picture fore offshore wind. Despite growing annual installation rates, Europe will not install anything like the offshore wind volumes it needs to reach its energy and climate targets. Europe would need to install more than 8 GW on average per year over the period 2022-2026.